Bitcoin debit cards have slowly become more mainstream with the rapid growth of blockchain technology. But with an increasing number to choose from, how do you decide which is best? Which crypto payment method lives up to their debit card review and which ones can you be sure are not scams? We’ve done our own research, and many of us here at Genesis Mining use different cards. Based on our own experiences, here is a list of digital currency cards that we think are trustworthy.

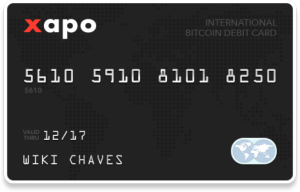

One of the better known cards, and one of the first to make a mainstream launch, is Xapo’s Bitcoin debit card. It is not a prepaid card, unlike many others. Instead it debits charges directly to your Xapo Bitcoin wallet. Despite the fact that the card can be used in billions of locations around the globe (basically anywhere that a Visa debit card is accepted), it cannot be used in the United States, Venezuela, Vietnam, and a number of other countries. That may be a drawback for a lot of users, but for non-U.S. residents, this card has a lot to offer. The fees are reasonable compared to other companies, and most users report that they are pleased with the card’s function. Additionally, with the Xapo card you do have peace of mind knowing that the company is a legitimate service and not a scam.

Based out of Honk Kong, ANX offers a couple of debit cards, one based on HKD and the premium card based on USD. We like their premium card a lot, particularly because it has eliminated a lot of the fees it used to have and can be used in the U.S. Their mobile application also allows users to track global market exchanges and recharge your debit card. The downside, however, is that ANX requires thorough ID verification, including multiple forms of government issued identification. For users who want to remain anonymous, this may not be the right card.

For users concerned about privacy, you may consider Coinkite. This card may not be as flexible as others, but they go the extra mile in guaranteeing your privacy. You retain your Bitcoins in your wallet, all transactions require multi-signature verifications, they operate at 100% liquidity (you can access all of your funds 24/7), and have numerous transparency tools that you can use to verify the funds in your account once a deposit is made. That said, the service comes with drawbacks. It does not function with regular ATMs or for transactions outside of Bitcoin. This card is strictly for the convenience of making an exchange or transaction via Bitcoin.

While not perfect, Cryptopay is a company to watch. They will be launching their debit card in the U.S. soon, which will make their reach truly global. What we like is the functionality. It operates just like a conventional card at millions of locations around the world, can be used at ATMs to withdraw cash, and you don’t have to provide identification for their lower level debit card. We are excited to see if they are able to maintain that exception and if it will apply in the U.S. But their are drawbacks, namely in their fee structure. While not a deal breaker, they do have more fees, and in some instances higher fees, than their top tier competitors. It’s something to consider before making a selection!

Debit cards have a long way to go, and they’ll get there the more the cryptocurrency market demands them for the transfer of USD to Bitcoin. Obviously a big challenge is the regulatory environment that dictates how money is spent, and any Bitcoin credit or debit card that transacts with conventional currency will have some hoops to jump through. We are optimistic that solutions can be found, and that these cards will only improve with time!