What’s that you say? You don’t know the first thing about what fractional-reserve banking is or how it works? You’re not alone. We recently conducted a study of 1,000 US consumers and nearly 26% of respondents believed that banks were required to hold 100% of customer deposits in reserves.

This article will explain why that’s not accurate and is meant to serve as a primer on fractional-reserve banking by answering basic questions about what exactly fractional banking is, how it came to be, how it works, and its pros and cons. You may just figure out that fractional-reserve banking is, or could be, a larger part of your life than you ever realized.

And, for crypto enthusiasts, this article may serve as a reinforcement that we need to move away from fractional-reserve banking into more sustainable, inherently fair and secure means of exchange and wealth management.

What is fractional-reserve banking?

Source: Bankroll Zen

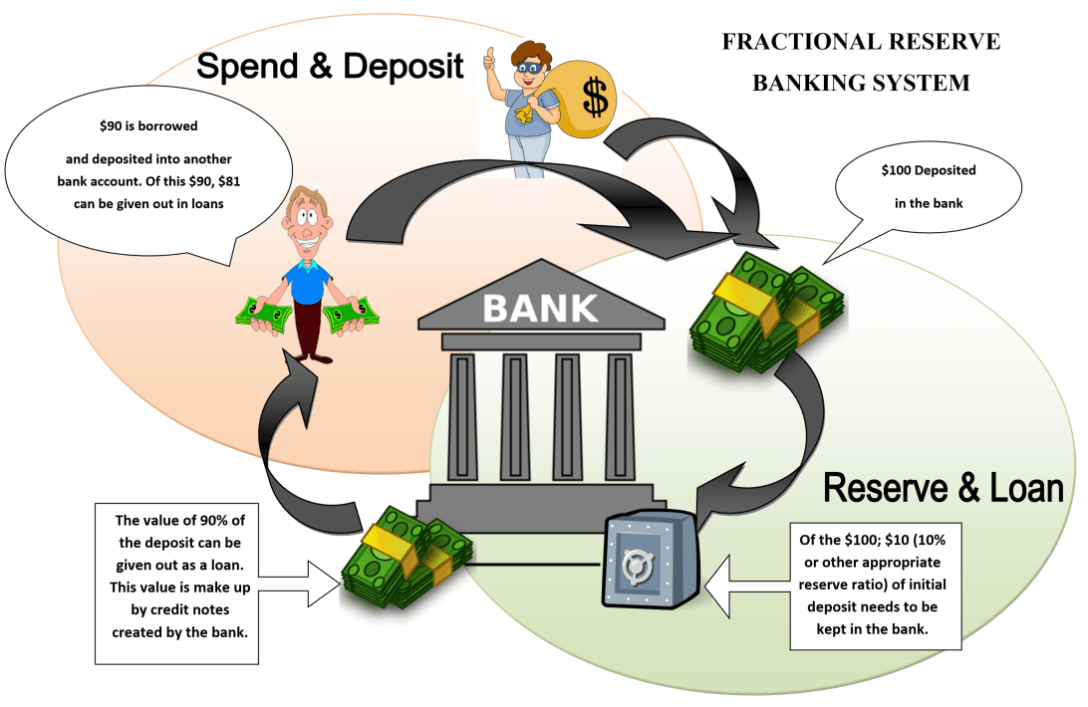

Fractional-reserve banking is a system by which banks lend out their customers’ deposits to generate a profit through interest. You may think that your money is being stored in some vault in your bank of choice — 26% of respondents in our recent survey of 1,000 US consumers believed that banks are required to keep 100% of deposits in their reserves. Newsflash: they’re not required to keep all customers’ deposits on hand — not by a long shot.

The ‘fractional’ in ‘fractional-reserve banking’ alludes to the fact that banks are only required to hold a fraction of deposited funds in their reserves. While that fraction remains stored with an account within the central bank or in the bank’s immediate currency reserves, much of customers’ deposited funds are lent back out to earn the bank money through interest payments.

Fractional-reserve banking essentially allows banks to use the capital of savers as credit for borrowers. Proponents argue that this is critical to powering the wheels of the American economy, while critics are more concerned with bank runs and other risks that have arisen from the flaws in the fractional-reserve banking system.

What’s the history of fractional-reserve banking?

Some believe that fractional-reserve banking dates back to some unnamed goldsmith who realized that he could lend out a portion of his gold, earn interest on it, and sneak it back into the reserves before anyone was the wiser. That may be the case, but we tend to point to more tangible examples when detailing the history of the modern fractional-reserve banking system.

Most believe that the origins of fractional-reserve banking lie in the Early Middle Ages. As more people stored their wealth with banks, they wanted to simplify the process for paying for goods and services. So instead of guaranteeing that you would receive the exact same coins you deposited when a customer chose to withdraw them, banks began to treat a deposit balance as an IOU of sorts.

This allowed banks to transfer coins from one account to another as a form of payment between two customers, instead of a customer having to withdraw their coins, pay a fee to do so, hand those coins over to the person they wished to pay, etc. These systems evolved into the 1400s and today, where banks have the freedom to transfer funds between accounts and even loan your funds out to a third party, so long as they maintain a legally required amount of customers’ deposits in their reserves.

How does fractional banking work?

In order to understand fractional-reserve banking, it’s helpful to start with 100%-reserve banking. Banks that are 100%-reserve banks keep one-hundred percent of their customers’ deposits in their reserves, whether that’s in-house or in an account with the central bank. Fractional-reserve banking states that banks must only keep a fraction of customers’ deposits — typically far less than 100% of them — in reserves at any given time.

So, let’s say that a bank has $50 million in customer deposits. Most banks are required to keep 10% of customer deposits in their reserves, so in this instance the bank would have to keep $5 million on hand. Once it has satisfied that requirement, bank decision makers are free to loan out the remaining $45 million in customer deposits as a means to accrue interest and add to its coffers.

Reserve requirements in America are set by the federal reserve and can be manipulated as a tool to stimulate economic activity. The interest that the banks collect as loans are repaid grows the money supply, and that growth is often exponential. Here’s why:

Once a bank loans out their available $45 million in deposited money to, let’s say, Tom, then Tom can deposit that money into another bank. So the lending bank keeps the $45 million on their books, and Tom will pay it back (at least in theory) over time, plus interest. Yet the bank into which Tom deposited the borrowed $45 million also adds that money to their books. This cycle can continue from bank to bank, resulting in enormous growth of the overall money supply.

What are the benefits of fractional banking?

Fractional-reserve banking has its benefits, including freer availability of credit and the ability for bank’s to reap additional money for their reserves. At least theoretically, these additional revenues will be seen by the customer in the form of interest on their bank deposits.

What are the disadvantages of fractional banking?

Critics of the fractional-reserve banking system don’t hold back: it’s a Ponzi scheme, they say. You’re robbing Peter (the depositor) to pay Paul (the borrower), and this is not sustainable in the long-run. Whether you agree with this perspective or not, there are glaring downsides of fractional-reserve banking that are difficult to refute.

For one, the money-multiplier effect of fractional-reserve banking results in a growing money supply. As the money supply grows — especially in the exponential manner created by the lending of financial reserves — the value of a dollar becomes less, which we also call inflation. A steady rise in inflation, say three percent, is to be expected and is generally associated with a healthy, growing economy. But over time, the rapidly growing money supply has seemingly resulted in a massive decrease in the U.S. dollar’s purchasing power.

Bank runs are also of concern. Say that signs of economic trouble cause 50%, or 100%, of a bank’s customers to withdraw their deposits. Well, the bank only has 10% of those funds on hand, let alone 50% or 100%. This scenario can cause widespread panic resulting in a Depression.

Similarly, if banks lend their money out unwisely (see: sub-prime mortgages), money may simply never be repaid as unqualified borrowers default on their loans. This means you’ve essentially flushed bank customers’ deposits down the drain, and doing this systematically can precipitate a recession or worse, as we witnessed in 2008-9.

Critics of fractional-reserve banking argue that the system contributes to the destruction of money’s real, intrinsic value. Combined with the rejection of the gold standard in both 1933 and 1971, fractional-reserve banking has rendered currency truly fiat.

For this reason, many see cryptocurrencies as a viable alternative with real, intrinsic value and systems that prevent straying too far from truly the truly collateralized medium of exchange.

Download our Free 13 page Exclusive Report:

The Perceptions of Money & Banking in the US 2019