Most everybody has heard of the Federal Reserve, but you’re not alone if that’s about as far as your knowledge of the Fed extends. We recently conducted a study of 1,000 US consumers and when asked the question, do you know what the Federal Reserve does? Nearly 50% of respondents answered either no (34%) and I don’t know (15%).

For those of you who don’t know exactly, in short, the Federal Reserve is the central banking system of the United States of America, but this alone is just too simple of an explanation to be truly useful to you. So, we’ve answered some basic questions that will beef up your understanding of the Fed and its importance to your life.

What is the federal reserve?

As the central bank of the United States of America, it’s comprised of twelve regional banks intended to reflect the geographic and cultural diversity of the nation, and the attitudes that define that diversity.

The Federal Reserve Board of Governors (more on them later) reside in Washington, D.C., while the Fed maintains regional branches in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco.

The Federal Open Market Committee (FOMC) is an essential element of the Fed that includes the Board of Governors plus the heads of five regional Fed bank heads. Their primary role is to set the specifics of monetary policy by adjusting the federal funds rate (more on that below).

What does the federal reserve do?

Decision makers within the federal reserve aim to ensure the continuing health of the American economy. They set out to achieve this goal through five general functions, as stated by the Fed itself:

1) Promoting the stability of the financial system by minimizing and containing systemic risks through ‘active monitoring and engagement’ in the U.S. and abroad

In other words, the Fed aims to detect potentially harmful trends in domestic and global financial markets and to counteract them by imposing regulation, providing payment services, and altering monetary policy to minimize risk. Achieving long-term economic stability is the overarching goal of the federal reserve.

2) Conducting the United States’ monetary policy

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System charged with dictating monetary policy. The twelve-member panel meets eight times per year, discussing trends in inflation and employment. These trends inform any changes that the committee will or will not make to the federal funds rate, which directly impacts national interest rates.

In times of high inflation, the Fed may raise the federal funds rate, while economic contraction may call for lowering the federal funds rate. Often, they do neither.

3) Regulating and supervising financial institutions

The idea here is pretty straightforward: implement new legislation and enforce existing policy to curb risky practices by financial institutions.

4) Provide payment services

The Fed carries out several duties critical to everyday banking, such as:

- Clearing checks and electronic payments

- Processing Social Security payments and government payroll checks

- Ensuring that Fed-backed banks have enough currency on hand

These duties of the Fed ensure that the wheels of the American economy continue to spin.

5) Promote consumer protection

Again, this mostly means implementing and enforcing legislation aimed at protecting the consumer from predatory, deceptive, or misleading financial practices.

Who owns the federal reserve?

In short, nobody. Created in 1913 as America’s central bank, the Fed is guided by a Board of seven Governors, nominated by the president and confirmed by the Senate. Each nominee serves staggered, 14-year terms, with one member’s term expiring on January 31 in each even-numbered year.

So, while the President, Senate, and Fed Board of Governors have influence over the makeup and policy of the Fed, it is technically an independent entity owned by nobody. Congress does have the power to limit the Federal Reserve’s autonomy on some level, as they showed with the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, but it would be inaccurate to label Congress as the owner of the Fed.

What’s the history of the federal reserve?

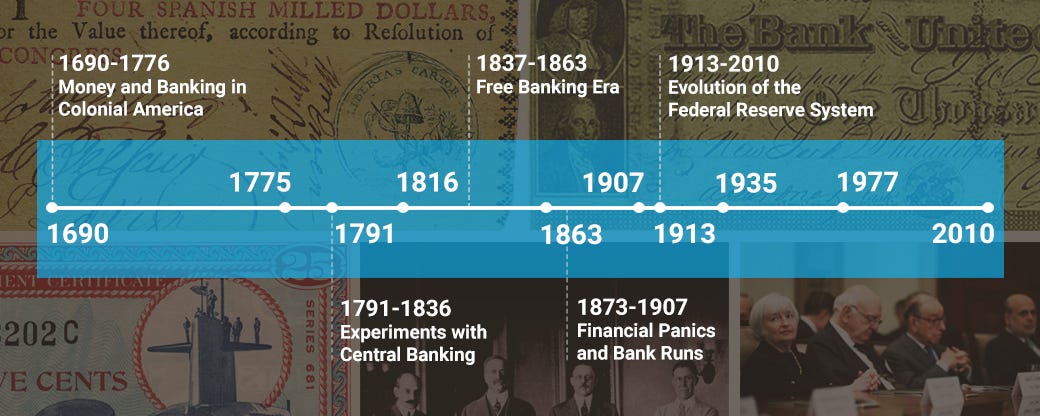

The federal reserve came to be when President Woodrow Wilson signed the Federal Reserve Act into law on December 23, 1913. The idea was to stabilize an emerging American economy regularly plagued by panics, bank failures, and a shortage of reliable credit, and the seeds of this idea were planted long before the Fed’s official inception.

The Fed as we know it has come to resemble then-Secretary of the Treasury Alexander Hamilton’s long-held plans for a federal banking system. There was a vast shortage of credit in the wake of the American Revolution, and Hamilton saw a system of unified banks, along with a national currency, as the answer to the credit shortage.

The evolution of the modern Fed began with the chartering of the First Bank of the United States in 1791. That evolution continued when Congress chartered the Second Bank of the United States in 1816, though it would ultimately not be re-chartered when President Andrew Jackson vetoed the charter in 1836.

A series of banking runs, panics, and crashes throughout the 1800s and early 1900s precipitated the creation of the Fed as we know it today.

Why does the federal reserve system matter?

Those old enough to recall the lengthy series of recessions that have occurred throughout American history may already know the answer to this question. Heck, even millennials remember The Great Recession of 2008–9, considered the most devastating and longest-lasting financial downturn since the Depression of 1929.

So if you’re wondering why the federal reserve matters, the simple answer is that — at least in theory — the federal reserve insulates us from a greater number of prolonged financial crashes. Depending on your economic school of choice, it’s arguable that the Fed is a useful tool for easing the depth and length of financial downturns when they do occur.

In terms of its non-emergency role, the Fed’s dual status as detector of financial malfeasance and provider of credit serves an invaluable role within the American and global economies. Despite its seemingly invisible impact, the Fed plays a greater role in all of our lives than most realize.

Download our Free 13 page Exclusive Report:

The Perceptions of Money & Banking in the US 2019