Last week we asked our miners to tell us what they think about increasing the blocksize. Miners are affected by this change as much or more than anyone else, and we have received a lot of feedback about this issue.

So we hosted a poll. In it we laid out the pros and cons of both alternatives – increasing the block size and not tampering with the blocksize. This is a summary of how we represented each point of view:

Against an increase of the block size:

- bigger blocks will destroy the market for transaction fees: if block space is not scarce, a market for transaction fees will not be established. Thus, the block reward might dwindle in the long run.

- requirements for full nodes increase: bigger blocks require more bandwidth which might make it harder to run a full node.

For an increase of the block size:

- capacity too low to support a global payment network: the current transaction amount is not sufficient to support a global payment network. Transactions would become more expensive and the blockchain will only be used for settlements between large players.

- greater block size will increase the total transaction fees: it is up to the miners to take a small fee for each transaction. Allowing many transactions in one block will increase the total transaction fee, which will be a benefit for miners in the long run.

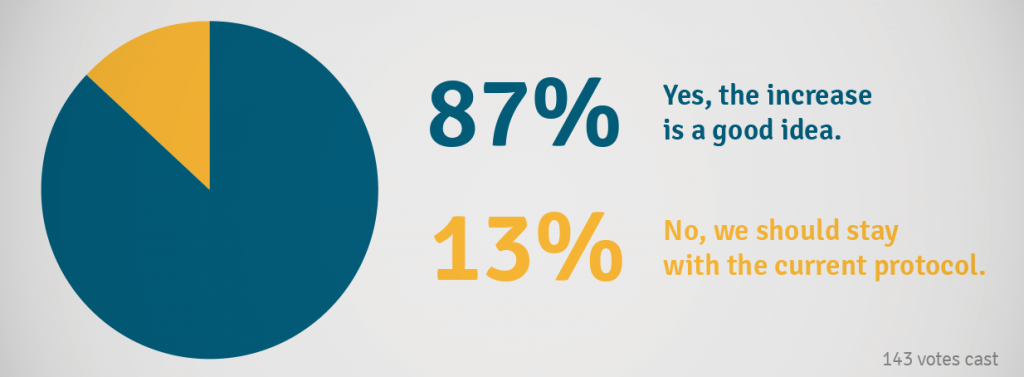

And these are the results:

These results speak for themselves. Miners support increasing the block size by an overwhelming majority, and we agree with that position. The future of Bitcoin is unclear, but we know that to become competitive as a global currency, we need to increase our ability to process transactions.

Have anything else to add? Please post it in the comments below, we’d love to hear from you!